Help your customers create a more energy efficient home

We created the ING Green Upgrade Loan and Home Energy Helper to help your customers make their homes more energy efficient.

Potential benefits of a more energy efficient home

ING Green Upgrade Loan

With a competitive fixed rate and no upfront fees, our Green Upgrade Loan could help your customers keep more money in their pockets when making energy efficient home upgrades.

Competitive fixed rate

Enjoy a 5-year fixed rate of just 3.74% p.a. (comparison rate 4.97% p.a.) with principal and interest payments for owner-occupiers or 3.74% p.a. (comparison rate 5.06% p.a.) for investors.

No upfront fees on the Green Upgrade loan

So more money stays in your client’s pocket.

Flexible loan size

Your client could borrow between $5,000 and $50,000.

Flexible loan term

Your client can either pay it off early or let it automatically convert to a variable rate Mortgage Simplifier loan at the end of their Green Upgrade Loan 5-year fixed-rate period for the remaining term of their loan.

For owner occupiers and investors making principal and interest repayments. Different comparison rates apply if the applicable variable rate following the expiry of the fixed interest period is an investor and/or interest only rate. Comparison rate: The comparison rate for the home loan is based on a loan amount of $150,000 over a loan term of 25 years.

WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

Eligible energy efficient upgrades include:

- solar photovoltaic panels and inverter

- battery

- hot water heat pump*

- induction cooktop*

- air conditioner (non-ducted single-split)*

- solar hot water system

- insulation

- double glazed windows

- EV charger

- ceiling fan

- energy monitoring system

- pool pump

*Including the removal of gas connections and relevant gas appliances if required.

Help your customers get some cashback

Right now, if you help your customers take out an ING Green Upgrade Loan and install energy efficient home upgrades by 31 March 2026, you could help them pocket $500 cashback.

Your customer can either use Home Energy Helper to find an accredited installer or they can choose an eligible BYO installer. Click here for full T&Cs for the $500 cashback.

How to help customers apply

To get the ball rolling on an ING Green Upgrade Loan split follow these 4 simple steps.

Get your customer to complete an online energy assessment on Home Energy Helper to obtain a quote. If your customer wants to explore other upgrades or choose their own installer just be sure they are eligible.

Submit an ING Green Upgrade Loan application so we can assess the customer's eligibility and provide conditional approval.

Energy efficient upgrades installed!

Provide the customers' final invoice once upgrades are complete so we can settle their loan and release the funds.

How customers can electrify their homes?

We offer two options to help your customers make their home more energy efficient. They can either use Home Energy Helper, or an eligible BYO installer.

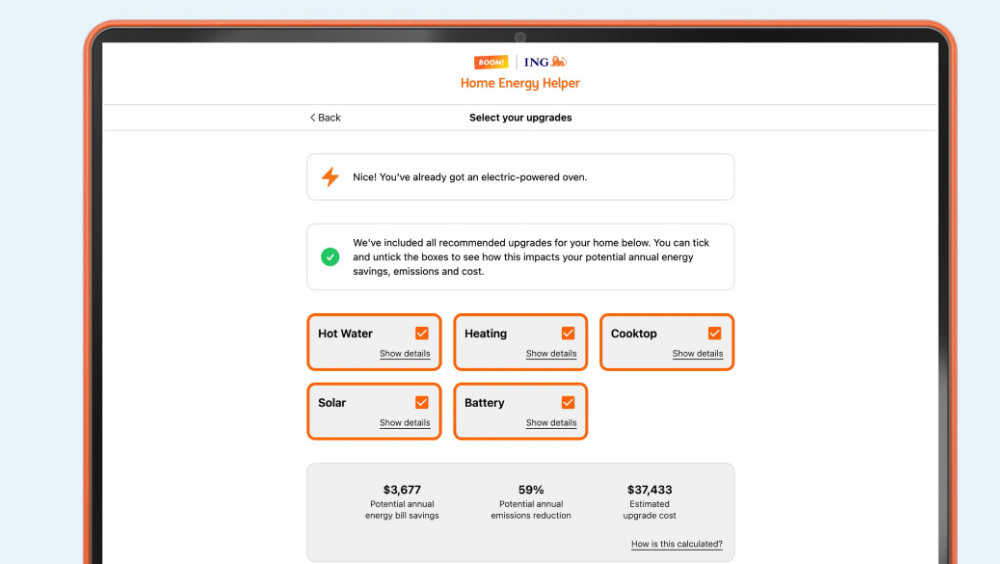

Home Energy Helper

Created in collaboration with BOOM! Power, Home Energy Helper is a one-stop planning platform that takes the hard work out of making home energy upgrades.

What your customers can do

Who's eligible for a Green Upgrade Loan

Only available to existing ING Home Loan (Mortgage Simplifier, Orange Advantage or Fixed Rate Loan) customers when:

Government rebates could help your customers save up to $6,500*

What's more your customer could combine Australia's current Small-scale Renewable Energy Scheme with the new Cheaper Home Batteries program, and they could save up to $6,500 on a typical 9kW solar system and 13 kWh battery system.

So, get your customer to grab a quote now with Home Energy Helper (ing.com.au/heh) to see how much they could save on a more energy efficient home.

*The estimated rebate amount is based on a 13kWh battery and a 9kW solar system, both with an average market pricing of $37 per STC (which may vary).

Why is our Green Upgrade Loan rate so low

ING Green Upgrade Loan is supported by the Clean Energy Finance Corporation (CEFC), an Australian Government-owned green bank set up to help finance Australia's clean energy transition to net zero emissions by 2050. The CEFC's $1 billion Household Energy Upgrades Fund provides discounted finance to consumers through a range of co-financiers to help increase housing sector sustainability.

Society is transitioning to a low-carbon economy. So are our clients, and so is ING. We finance a lot of sustainable activities, but we still finance more that’s not. See how we’re progressing on ing.com/climate

Society is transitioning to a low-carbon economy. So are our clients, and so is ING. We finance a lot of sustainable activities, but we still finance more that’s not. See how we’re progressing on ing.com/climate